In today's NetSuite guide, we’re going to discuss how to do bank reconciliation in NetSuite.

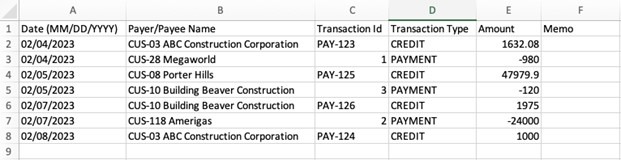

If the business is not currently using Bank Feeds feature for auto import of the bank transactions in NetSuite, bank reconciliation can start with importing them with CSV file.

Select the bank account in the Account field. Click “Import”.

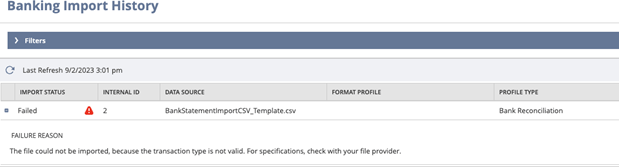

This upload status message will show to track the status. Click “Track your status” link.

If the import status shows “Failed”, check the reason, and update the CSV template.

If the import status shows “Completed”, the upload was successful and can proceed with the reconciliation.

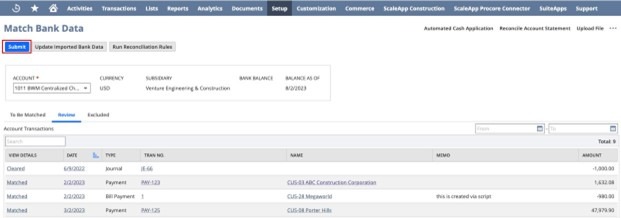

On the NetSuite Match Bank Data page, you can compare bank lines and account transactions imported into NetSuite. Navigate to Transactions > Bank > Match Bank Data.

You can take the following actions:

Select the Account to be matched. Review the matched bank transactions in the “Review” tab.

If you need to exclude the matched transactions, click the “Matched” link in the line, then pop-up will offer to undo the matching. Click “Undo Match”.

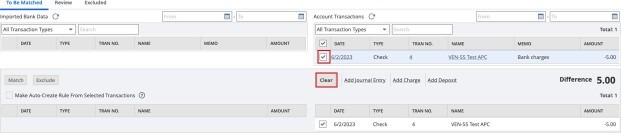

Click on the checkbox of each line to be matched. Click “Match” button.

Enter the required information such as payee, date, number, memo, amount, account, and dimensions of the entry.

Once done, the entry will show in Account Transactions. Click the checkbox and “Clear”.

The Summary area will show how much different from the reconciliation. The goal is to have zero difference, but the reconciliation can still be submitted even with differences.

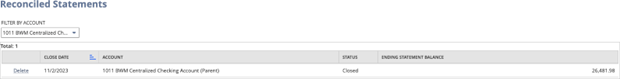

This pop-up message will appear to show the close date for the last reconciliation and its ending balance.

To generate the reports, navigate to Reports > Banking/Budgeting > Reconciliation > Detail. This NetSuite Bank Reconciliation Report can be generated and exported as csv, excel, word and PDF file.

Completing your bank reconciliation in NetSuite is crucial to guarantee that your cash balances are checked and balanced.

As a highly accredited NetSuite Solution Provider, ScaleNorth is well positioned to help you with the full scope of your NetSuite customization needs. If you require more NetSuite assistance, contact ScaleNorth today.

Bank reconciliation ensures your financial statements are accurate and supports proper internal controls. It reduces manual reconciliation errors, improves audit trail compliance, and helps finance teams make better decision-making regarding customer payments, bank fees, and overall cash management.

Yes, NetSuite supports automation to streamline the reconciliation process. Automated reconciliation reduces manual effort, data entry, and errors when handling high volumes of transactions, while ensuring accurate journal entry postings to the general ledger. You can also utilize third-party tools like ZoneReconcile to further streamline and automate the bank reconciliation process.

The NetSuite Account Reconciliation module provides a user-friendly solution for finance teams to manage accounts receivable, credit card statements, and other accounts. It offers real-time visibility into the financial close and month-end close process, reducing time-consuming manual tasks.

With automated reconciliation, intelligent matching rules, and integrated workflows, NetSuite accelerates month-end processes, ensures timely account reconciliation, and improves the accuracy of financial reporting.

Yes, NetSuite can reconcile credit card and bank statements, manage high volumes of transactions, and provide real-time insight into cash flow and other metrics.

Unlike QuickBooks, which requires significant manual reconciliation, NetSuite provides automated reconciliation, supports role-based access, and integrates with other financial management processes, giving teams real-time visibility into financial records.

By integrating workflows, matching rules, and automated reconciliation, NetSuite reduces manual effort, prevents discrepancies, and ensures financial records are accurate for decision-making.

NetSuite can reconcile bank accounts, credit card statements, accounts receivable, and other modules within the financial management system, supporting both internal controls and audit trail compliance.