Undeposited Funds are simply payments received from customers that have not been deposited to your bank account or are not yet reflected immediately on your bank account.

The most common example is a check received from your customer. You have physically received the check but have not yet deposited the check to your bank account hence this should be tracked under Undeposited Funds to track cash inflow in a timely manner.

4. Hit Save.

5. The GL impact will be: Debit Undeposited Funds, Credit the Revenue Account of the item.

6. The Status of the Cash Sale will be “Not Deposited”.

1. Open an Invoice and click Accept Payment to be routed to the Payment Page.

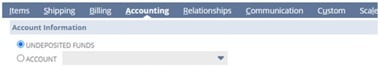

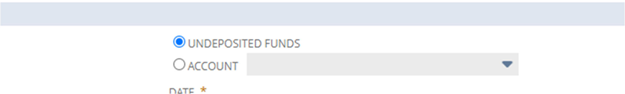

2. Select Undeposited Funds (on the Header of the page).

3. Review details and hit Save.

4. The GL impact will be: Debit Undeposited Funds, Credit Accounts Receivable.

5. The Status of the Payment will be “Not Deposited”.

1. Go to Transactions > Bank > Make Deposits.

2. Select the Bank Account.

3. On the Deposit tab, the Payments subtab will list all payments posted to Undeposited Funds Account.

4. Check the box next to each item to include in this deposit.

5. Click Save.

6. The GL impact will be Debit to the selected Bank Account and Credit Undeposited Funds account.

7. The Status of the Cash Sale and or Payment will be changed to “Deposited”.

As a highly accredited NetSuite Solution Provider, ScaleNorth is well positioned to help you with the full scope of your NetSuite customization needs. If you require more NetSuite assistance, contact ScaleNorth today.

Diana Ting is a Principal Implementation Consultant, CPA, and a Certified NetSuite ERP Consultant. With a multi-faceted skill set, she holds certifications as a NetSuite Administrator, Financial User, and Analytics User, underscoring Diana's comprehensive understanding of the platform's intricacies. Furthermore, Diana's expertise extends to NetSuite ARM and Multi-book Authorization, showcasing her advanced proficiency.